The Speculation surrounding the outcome of India’s ongoing national elections has injected a sense of unease into the country’s $4.6 trillion stock market, triggering a flurry of activity among traders and investors. The peculiar behavior of India’s volatility indicator, the India VIX, commonly referred to as the fear index, has added to the apprehension, leaving many in the market puzzled.

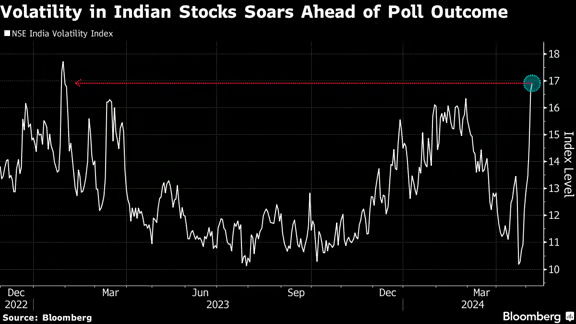

The India VIX Index, which utilizes equity option prices to forecast market volatility over the next 30 days, has witnessed a dramatic surge in recent days. After experiencing a significant crash of over 20% to below the sub-10 mark on April 23, the fear gauge has risen for a ninth consecutive day, marking its longest streak since March 2020. This surge comes on the heels of the fear index hitting a record low just two weeks prior and is now inching closer to its highest level since early 2023.

Despite widespread expectations of Prime Minister Narendra Modi securing a third five-year term, attention has shifted to concerns regarding the ruling coalition’s performance in the election. Reports of a dip in voter turnout during the initial phases of voting have fueled speculation among equity traders, with some anticipating a less emphatic victory for the Bharatiya Janata Party (BJP) and its allies.

In the 2019 election, the BJP secured an expanded majority with 303 seats, while the current alliance commands 353 seats.

Mukesh Jain, managing director of Jaipur-based Maverick Share Brokers Pvt, highlighted the prevailing chatter among traders, suggesting that if the BJP were to win between 290-300 seats, the markets would likely experience a significant reaction.

India’s benchmark NSE Nifty 50 Index has mirrored this uncertainty, sliding as much as 0.9% in a third consecutive day of declines on Tuesday, nearing its lowest close since April 19. This decline comes amidst a broader uptrend in Asian stocks, highlighting the unique challenges facing Indian equities.

The Election Commission of India has expressed disappointment with the voter turnout thus far and is implementing measures to boost participation in the remaining phases of polling. As voting commences in Modi’s home state of Gujarat in the third phase of the election, concerns about the potential deviation between expectations and reality regarding the BJP-led alliance’s seat count continue to loom large.

Dhananjay Sinha, co-head of equities at Systematix Group, emphasized the uncertainty prevailing in the market, attributing the recent surge in the VIX to concerns about potential electoral outcomes. While a victory for Modi’s party remains the most anticipated outcome among traders, Jain dismissed the possibility of the BJP-led alliance failing to secure victory, citing India’s political history.

“There is a chatter that BJP may win 290-300 seats and if that happens, markets will surely see a blip,” said Mukesh Jain, managing director of Jaipur-based Maverick Share Brokers Pvt, which has been tracking the markets for over two decades. India’s benchmark NSE Nifty 50 Index slid as much as 0.9% in a third day of declines on Tuesday, heading for its lowest close since April 19. That’s even as a broader gauge of Asian stocks advanced for a fourth day.

Frankly, I don’t see any possibility of this,” Jain of Maverick Share Brokers said when asked about the chances of the BJP-led alliance failing to win the election. “I haven’t really thought of this scenario.”

Further, the recent weakness in Indian stocks is coming after a period of extended outperformance versus regional peers. Strategists at global banks from Goldman Sachs Group Inc. and JPMorgan Chase & Co. have said that Indian equities are set to attract more foreign inflows post the general elections on bets that Modi, who has promised continued spending on infrastructure, will return to power.